UNIT-III:CONSUMER ORIENTED E-COMMERCE APPLICATIONS: Introduction - Mercantile Process Model: Consumers Perspective and Merchant’s Perspective - Electronic Payment Systems: Legal Issues & Digital Currency - E-Cash & E-Cheque - Electronic Fund Transfer (EFT) - Advantages and Risks - Digital Token-Based E-Payment System - Smart Cards.

UNIT-IV:ELECTRONIC DATA INTERCHANGE: Introduction - EDI Standards - Types of EDI - EDI Applications in Business – Legal - Security and Privacy issues if EDI - EDI and E-Commerce - EDI Software Implementation.

UNIT-IV

EDI refers

to the exchange of electronic business documents I.e. purchasing orders,

invoices, etc. between applications. The exchange involves no paper, no human

intervention and takes place in a matter of seconds. EDI documents are

formatted using published standards. EDI requires a network connection between

the two companies exchanging business documents.

- Purchasing orders

- Invoices

- Shipping Requests

- Acknowledgement

- Business Correspondence documents

- Financial Information

EDI requires a network connection such as a dedicated leased line or a Value Added Network (VAN) between the two companies to exchange business documents. The two companies involved in EDI process are called as Trading Partners.

Steps in EDI:

The following are the steps in an EDI system:

- An Application program (Sender) generates the file

which contains the processed document.

- The document is converted into an agreed standard

format

- The document is sent to the receiver electronically on

the network

- The trading partner (Receiver) receives the file

- An Acknowledgement document is generated and sent to the sender

Advantages of EDI:

-Electronic form of data: It is easy to transfer or

share electronic format data.

-Reduction in data entry errors: There is a

less chance of errors in Computer generated documents.

-Shorter processing life cycle: Orders can be

processed as soon as they are entered.

-Reduction in paper work: A lot of paper documents are

replaced with electronic documents.

-Lower Costs: With a faster processing of orders and time saving, EDI lowers the costs in it.

EDI systems are of three types:

1.

Non-EDI systems

2.

Partial EDI systems

3. Fully integrated EDI systems.

Q.2) Explain about non-EDI systems?

Non-EDI Systems:

Non-EDI systems are traditional commerce activities that involve mail systems which require more number of individuals for manual processing of business documents.

The following figure illustrates the working of a typical non-EDI system:

Figure: Non-EDI systems.

1. A purchase request is completed by the production planning department. A purchasing agent reviews the purchase request and then manually reviews the available vendors for inventory availability.

2. Then he selects a vendor, completes the purchase order and mails it to the vendor.

3. The vendor receives the purchase order and prepares a sales order and sent it to the warehouse. Then the available goods are shipped and an invoice is prepared and sent to the customer.

4. Then the customer checks the invoice and processes it for payment. The customer’s cash disbursements department prepares a check and remittance advice and mails them to the vendor.

5. The Vendor’s cash receipt’s department receives the check, prepares a deposit slip and the accounts receivable department updates the records.

v The entire non-EDI process requires the use of multiple clerks by both the customer and vendor to complete a transaction. Thus it is a time consuming, costly process that results many errors in it.

Q.3) What is EDI? Explain about Partial EDI systems?

Partial

EDI System:

Partial EDI systems refer to the

activities that use only a limited computerized data processing in addition to

the traditional mail systems.

In a partial EDI system, the process begins the same as in a non-EDI system.

1. A purchase request is completed by the production planning department. A purchasing agent reviews the purchase request and then manually reviews and selects a suitable vendor.

2. Now, the purchasing agent fills out a computerized purchase order form. Then the purchase order form is sent to the vendor’s mailbox through VAN.

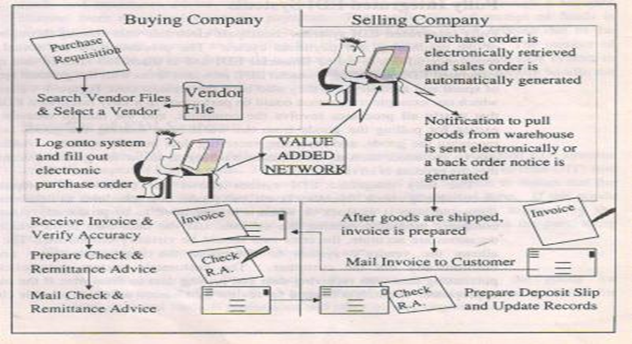

The following figure illustrates a partial EDI system:

Figure: Partial-EDI Systems

3. The vendor receives the purchase

order, generates a sales order form and sent to the warehouse.

Then the available goods are shipped and an invoice is prepared and sent to the customer.

4. After the goods are shipped, the rest of the process proceeds as in a non-EDI system.

Q.4) - What is EDI? Explain about Fully Integrated

Fully Integrated EDI Systems:

Fully integrated EDI systems include

the activities that use computerized data processing in all aspects of the

purchasing and payment cycles. So that it eliminates the human element in

processing the business documents.

Here, the

processing of the actual payment and remittance advice is called Financial EDI.

The following figure shows a fully integrated EDI:

Figure: Fully Integrated EDI Systems.

1. A fully integrated EDI system allows

the purchaser to electronically

prepare purchase request,

selects a suitable vendor and places a purchase order.

2. The vendor electronically receives the purchase order and performs all his activities electronically and sends an electronic invoice.

3. The purchaser receives the electronic invoice, verifies it and electronically transfers funds. Then the vendor receives the electronic notification of funds and remittance advice.

Q.5) What is VAN? Explain

Value Added Networks - (VAN):

In the organizations, The EDI process is implemented through third party network services, called Value-Added-Networks (VAN). The services provided by most VAN’s include:

1. EDI translation

2. Security assurances of data

3. Reliability of services due to

multiple Telecommunication links

4. EDI systems development

assistance

5. Employee training sessions.

Figure: VAN.

Role of VAN:

1. To execute only authorized

transactions with valid trading partners.

2. To enable the VAN to distinguish authorized transactions and valid trading partners.

Companies view EDI messaging as a function to be outsourced to a specialist. VANS provide this outsourcing function and serve as a messaging station for trading partners. Messaging can be transmitted from one party's VAN to the other party's VAN.

When a trading partner send a request for information to VAN .VAN transmit the data immediate back to the requesting partner with out needing to contact to the vendor. If VAN does not have the requested data, it requests the vendor for the data. After getting the data from the vendor, it sends back to the trading partners.

Q.6) What are the pre-requisites for EDI?.

Pre-Requisites for EDI

Planning for EDI implementation is an

important factor for success.

The steps required for EDI is:-

1. Identify organizational needs for

EDI

2. Weigh the cost and benefits of EDI

3. Identify EDI business partners

4. Obtain top management approval

5. Form an EDI project team

6. Education & training

7. Determine EDI standards

8. Determine the connection options

9. Implementation planning.

1.

Identify organizational needs for EDI:-

-First, study

the company's existing work flow and how it can be improved using EDI.

-This study should attempt to cover the whole range of data and information of the entire company.

2.

Weigh the cost and benefits of EDI:-

-Weigh the

benefits of EDI against the costs of setting up the EDI system.

-Ongoing costs such as VAN charges, maintenance and support costs need also to be taken into account.

3.

Identify EDI business partners:-

-In this phase,

identify the business partners with whom to implement EDI.

-Upon identification of business partners, discuss with them about the possibility of establishing an EDI link.

4.

Obtain top management Approval:-

-EDI implementation is a strategic business issue. It requires management’s approval to ensure that the EDI implementation is a overall company’s objective. Top management has the authority to approve the necessary resources required for EDI.

5.

Form an EDI project team:-

EDI implementation involves those personnel who are experts in their business areas to address the requirements of all its departments EDI project team can be headed either by an in-house expert(with IT & EDI experience) or by external consultants.

Training & education programs can also be used as a powerful tool to demonstrate senior management support of EDI. The training program should cover specific areas of user operation & how to use the system.

7.

Determine EDI standards:-

It is necessary for organizations to adapt a common set of standards for communications. These standards need to be agreed by you and the businesses partners.

8.

Decide on the connection options:-

Determine whether to build a own network or selecting a third party VAN.

9. Implementation planning:-

At this stage, decision will be taken for an appropriate implementation plan.

Q.7) Discuss about the legal, security and Privacy issues in EDI

Legal, Security and Privacy issues in EDI

In EDI, Trading is done between countries and corporations. So, the legal, security and privacy issues become very important concerns.

Legal

Issues:

- Companies that deal with EDI should take the services

of a lawyer during the design of EDI applications, so that

evidentiary/admissibility safeguards are implemented.

The United Nation’s Contract Law

defines 3 types of communications:

1) Instantaneous Communication: - If the parties are face to face or use an instantaneous communication medium such as telephone.

2) Delayed communication via USPS: - The mailbox rule provides that an acceptance communicated via postal service mail is effectively communicated when dispatched or physically deposited in a USPS mail box.

3) Delayed communication via Non-USPS:-Acceptance communicated via telegram or other electronic messaging system are communicated and operable.

EX: - Couriers, Telegram

Privacy

Issues:

Maintaining the privacy of the trading information over EDI is essential. The data that is collected in an EDI process should be protected. There are several solutions to protect privacy, such as Merchant privacy policy, Network privacy policy and the enforcement of existing and new laws.

Security Issues:

EDI should include three levels of

security:

-Network Level

Security

-Application

Level Security

- Message Level Security

Network Level Security: Network level security authenticates the users with a valid user-Id and password. So that it allows only authorized network uses to access the EDI resources.

Application Level Security: Application level security controls access to the EDI system through its application program. It provides access to different levels of usage by authenticating the user accounts.

Message Level Security: Message level security provides security to the message content in order to keep its safety and privacy from un-authorized access. Message level security can be applied by various techniques such as Encryption, Hashing and Digital Signatures, etc.

Q8.Explain

Different types of EDI Applications used in Business?(VIMP)

Ans: EDI business applications

1. International or cross-border trade: EDI has always been very closely linked with international trade. Over

the last few years, significant progress has been made toward the establishment

of more open and dynamic trade relations. Recent years have brought the General

Agreement on Tariffs and Trade (GATT); the Free Trade Agreement (NAFTA) among

the United States, Canada, and Mexico; and the creation of the European Union.

These developments have meant the lifting of long-standing trade restrictions.

Many countries, and in particular developing countries, have made significant

efforts to liberalize and adjust their trade policies. In this context, trade

efficiency, which allows faster, simpler, broader and less costly transactions,

is a necessity. It is a widely held view that trade efficiency can be

accomplished only by using EDI as a primary global transactions medium.

2.

Financial EDI or electronic funds transfer (EFT): Financial EDI comprises the electronic transmission of payments and

remittance information between a payer, payee, and their respective banks. This

section examines the ways business-to-business payments are made today and

describes the various methods for making financial EDI payments. Financial EDI

allows businesses to replace the labor-intensive activities associated with

issuing, mailing, and collecting checks through the banking system with

automated initiation, transmission, and processing of payment instructions.

Thus it eliminates the delays inherent in processing checks.

Types of Financial EDI: Traditionally, wholesale or business-to-business payment is accomplished using checks, EFT, and automated clearinghouses (ACH) for domestic and international funds transfer. ACH provides two basic services to industrial and financial corporate customers (including other banks):

(1) fast transmission of information about their financial balances throughout the world, and

(2) the movement of money internationally at rapid speed for settlement of debit/credit balances. Banks have developed sophisticated cash management systems on the back of these services that essentially reduce the amount of money companies leave idly floating in low-earning accounts.

3.

Health care EDI for insurance claims processing: Providing good and affordable health care is a universal problem. In

1994, the American public spent $1 trillion on health care, nearly 15 percent

of the gross domestic product (GDP). National health care expenditures have

risen by 10.5 percent each year for the past eight years—more than double the

rate of increase in the consumer price index. It is estimated that $3.2 billion

in administrative savings are expected to be achieved by switching from being

paper-based to an EDI implementation. Employers could save $70 million to $110

million by using EDI for enrollment and to certify that a prescribed procedure

is covered under the subscriber's health insurance contract.

4.

Manufacturing and retail procurement: Both

manufacturing and retail procurement are already heavy users of EDI. In

manufacturing, EDI is used to support just-in-time. In retailing, EDI is used

to support quick response.

a.

Just-in-Time and EDI: Companies using JIT and EDI no

longer stock thousands of large

parts in advance of their use. Instead, they calculate how many parts are needed each day based on

the production schedule and

electronically transmit orders and schedules to suppliers every day or its some cases every 30 minutes. Parts

are delivered to the plant

"just in time" for production activity.

b. Quick Response and EDI: Taking their cue from the efficiencies manufacturers have gained from just-in-time manufacturing techniques, retailers are redefining practices through the entire supply chain using quick response (QR) systems. For the customer, QR means better service and availability of a wider range of products. For the retailer and suppliers, QR may mean survival in a competitive marketplace. Much of the focus of QR is in reduction of lead times using event-driven EDI. Occurrences such as inventories falling below a specified level immediately trigger a chain of events including automatic ordering from one company's application directly into the other's application. In QR, EDI documents include purchase orders, shipping notices, invoices, inventory position, catalogs, and order status.

No comments:

Post a Comment